(719) 687-6364

Call to Get a Free Quote

Mon - Fri: 9:00 - 5:00

1155 Kelly Johnson Blvd, Suite 440

Colorado Springs, CO 80920

We moved to a new location! 1155 Kelly Johnson Blvd, Suite 440, Colorado Springs, CO

Call to Get a Free Quote

1155 Kelly Johnson Blvd, Suite 440

Colorado Springs, CO 80920

In the hustle and bustle of daily life, the last thing you want to worry about is something happening to your apartment, condo, or rental property. Storms, floods, fires, and other problems can all result in damaged or lost items and money loss. That’s why renters’ insurance in Colorado Springs, Colorado, is crucial. It helps protect what matters most and works like a home policy for anyone renting property. These insurance coverage options replace and repair damaged items and ensure you meet state and local insurance laws.

Thankfully, our crew at Alliance Insurance of the Rockies specializes in Colorado renters’ insurance, including for anyone living in El Paso County or Colorado Springs. Our team will help you select the ideal plan for your home protection, apartment protection, or condo protection needs. Contact us today to get started with free quotes on your insurance.

Renters’ insurance, or tenant insurance, is a vital form of low-cost coverage that provides strong protection for anyone in rental properties like apartments, condos, duplexes, or houses. Consider it a customized type of home insurance specifically for renters. These policies provide individualized protection you can trust to safeguard belongings and provide liability coverage in case of unforeseen events or damages, such as your dog biting a friend unexpectedly.

In Colorado Springs, Colorado, and El Paso County, renters’ insurance is essential for providing specialized insurance protection. It helps when replacing or repairing possessions and property damaged by problems like fire, theft, or natural disasters. Additionally, many landlords in Colorado require tenants to buy tenant insurance as part of their lease agreement. It’s a way for them to not only protect themselves but their renters as well.

Alliance Insurance of the Rockies is the most trusted insurance broker in Colorado Springs and will ensure you’re fully protected. Our amazing customer support team can help you choose a high-value policy that covers multiple issues and provides payouts for your needs. No matter what type of rental property you need to be covered, our team can ensure you’re safe by providing dwelling coverage, personal property protection, personal liability policies, loss of use coverage, and more. We provide next-level quality and five-star service.

Finding cheap renters’ insurance in Colorado Springs, Colorado, that protects you and your possessions can be complicated. For example, you must work hard to find a policy with reasonable deductible payments to ensure you get a high-value policy that protects your needs. Alliance Insurance of the Rockies can help you through this process and ensure you are satisfied with your protection. Here’s what you can expect when getting coverage with us:

With Alliance Insurance of the Rockies, securing reliable Colorado Springs renters’ insurance has never been easier. We’ll help you find home, apartment, or condo protection when renting property and ensure that your deductible payments are reasonable for your individualized protection and insurance coverage. Contact us today to get free quotes from our five-star service team. Expect next-level quality from our crew!

Tenant insurance is essential for Colorado residents who want a high-value policy that provides home protection, apartment protection, and condo protection that covers multiple elements. While not legally mandated in the state, many landlords require it. Beyond fulfilling landlord requirements, renters’ insurance can safeguard your belongings, particularly in emergencies. These policies provide strong protection for anyone renting property, including dwelling coverage, personal property, personal liability, and loss of use coverage.

That’s important because landlords must insure their buildings, but their coverage doesn’t extend to your personal belongings. So, if a fire ravages your apartment, your landlord’s insurance will cover the structure but leave you responsible for replacing your clothes, furniture, and valuables out of pocket. With renters’ insurance, you’d receive compensation for replacing your possessions and covering additional living expenses until you can return home.

Contact one of our expert insurance brokers to learn how renters’ insurance in Colorado Springs, Colorado, can provide crucial financial protection for you and your family. We’ll find a high-value policy that provides protection you can trust with reasonable deductible payments. Our great customer service team will sit with you to determine your needs.

Your renters’ insurance will vary depending on the company that ensures you and your chosen plan. At Alliance Insurance of the Rockies, we help Colorado Springs, Colorado, residents understand their options and narrow down their insurance coverage to find tenant insurance that makes sense for them. For example, you can purchase additional coverage for damage caused by flooding or earthquakes since these are not covered perils under many plans.

Since Alliance Insurance of the Rockies is a brokerage, we can help you review plans from the top renters insurance companies nationwide. We’re not affiliated with a specific company but work with multiple providers. That means our only priority is to help you find the perfect renters’ insurance in Colorado Springs! Our amazing customer support team will help you find low-cost coverage on a high-value policy to get protection you can trust at a fair price.

Most El Paso County home protection, apartment protection, and condo protection renters insurance plans will include the following types of coverage for anyone renting property in Colorado Springs and beyond:

Personal property coverage helps you replace destroyed or damaged items. Your insurance plan will discuss what counts as a covered incident but typically includes fire, theft, and hail. You can opt for replacement cost coverage or cash value coverage. Our great customer service team can help you find specialized insurance protection with next-level quality!

Accidents happen, and Alliance Insurance of the Rockies can help you pay for them as a renter. Medical coverage through your renters’ insurance lets you pay for those accidents and covers minor injuries to guests. In this way, you can rest easy knowing everyone in your home has coverage. You can call us for free quotes on this coverage to get individualized protection.

Alliance Insurance of the Rockies always recommends choosing a plan with personal liability insurance, especially if you like having friends over or regularly host parties. After all, if one of your guests gets injured in your home, this protection helps cover any costs. In this way, you just have to make your deductible payments for your policy to kick in to help you pay.

Loss of use coverage on your Colorado Springs renters’ insurance pays you to stay somewhere else if a covered loss makes your home unlivable. That way, you can focus on recovering your losses rather than worrying about where you’ll live in the meantime. That’s a huge bonus and part of five-star service support from our insurance provider partners.

Renters’ insurance costs depend on various factors, including who the provider is and how much your belongings are worth. At Alliance Insurance of the Rockies, we help Colorado Springs, Colorado, residents find a tenant insurance vendor who works well for their budget. On average, the most common personal property coverage for renters is $25,000 and $50,000, while personal liability coverage is somewhere between $100,000 and $300,000.

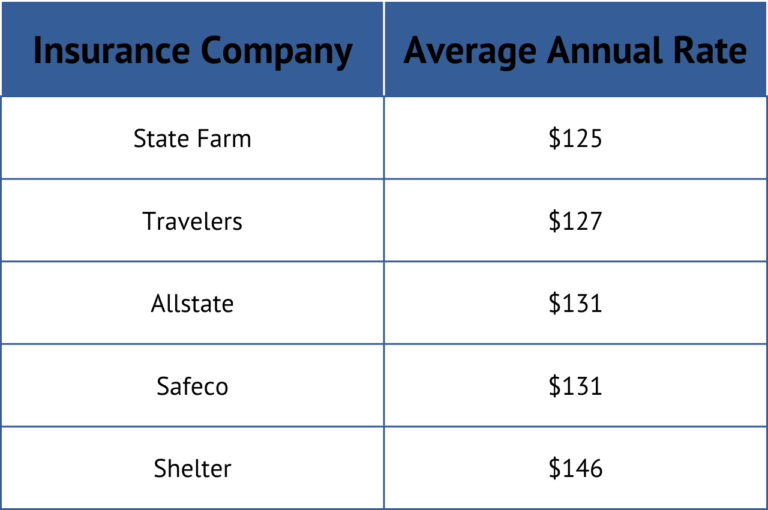

So please call us at Alliance Insurance of the Rockies to choose an affordable, comprehensive policy that fits your needs. We can help you find insurance coverage for home protection, apartment protection, condo protection, or any situation in which you’re renting property. Just know that renters’ insurance in El Paso County averages about $180 per year. The listed companies provide affordable renters’ insurance rates:

If you’re wondering how insurance companies in Colorado set rates, you’re not alone. Knowing why your strong protection costs a specific rate is crucial because it can help you find individualized protection and a high-value policy that makes sense. If you’re looking for protection you can trust with reasonable deductible payments, here are a few of the factors you can look at to ensure you get specialized insurance protection at a reasonable price:

If you want to know how much you can expect to pay for renters’ insurance, schedule a consultation with Alliance Insurance of the Rockies. We’ll help you find affordable tenant insurance in Colorado Springs, Colorado, and El Paso County that match your needs. With our help, you can get the affordable and reasonable protection that makes sense for you.

You don’t need to buy renters’ insurance in Colorado, but some landlords may require you to have renters’ insurance to become their tenant. At Alliance Insurance of the Rockies, we can provide Colorado Springs and El Paso County residents with excellent tenant insurance.

If you don’t have insurance coverage, home protection, apartment protection, condo protection, or policies when renting property, a severe disaster will leave you stuck paying the bills for your belongings. Don’t make this mistake: just get a policy to stay financially strong.

Most renters’ insurance policies cover various items, including clothes, appliances, jewelry, furniture, electronics, firearms, and books. Call us for free quotes on low-cost coverage to get the strong protection you need paired with our amazing customer support.

If your landlord has an insurance policy, it’s still crucial for you to obtain tenant insurance. Your landlord’s policy covers damage to their building or property but doesn’t protect you or your belongings. Personal property protection can keep you safe from profound loss.

In the meantime, you can make emergency, temporary repairs, such as boarding up windows. Contact the police, file a report, and contact your insurance representative if you had property stolen.

Personal liability provides individualized protection and five-star service with next-level quality on your policy. Just imagine what happens if someone gets hurt on your property and they need medical help. A high-value policy can ensure you don’t pay out of pocket.

Alliance Insurance of the Rockies provides great customer service for Colorado Springs and El Paso County renters. We find specialized insurance protection from strong providers and will sit down with you to ensure you get excellent coverage.

File a claim with your insurance representative as soon as possible to get help. If you need permanent repairs, contact your insurance company before taking any other steps. Remember that insurance companies have the right to inspect your property if it is damaged.

In the meantime, you can make emergency, temporary repairs, such as boarding up windows to keep your home safe. Contact the police, file a report, and contact your insurance representative for help with loss of use coverage to get protection you can trust.

People who want to reduce their deductible payments on things like dwelling coverage and other tenant policies can balance elements like premiums and other expenses. It’s important to talk with us about this process to ensure you get the long-term support you need.

Yes, renters’ insurance covers your belongings regardless of their location. However, there are always limits and exclusions to insurance policies. Discuss these with us immediately so you fully understand your coverage and get the insights you need to stay protected.

You and your roommates can share a policy if everyone is on the insurance agreement. Your roommates’ property is not covered under your insurance unless they are listed. That said, they can also opt for separate coverage to keep themselves safe from loss.

The average rent in Denver is about $1,994 monthly for a one bedroom, one bathroom apartment. The location of your place in Denver and the size of your apartment or house will help determine your rent. It can also impact how much you spend for your policy.

Your Denver rent can drastically differ from the city average, depending on where you live. If you live in Westwood, rent is typically more affordable. However, rent can jump to $2,521 for a home in Congress Park. Talk with us to learn more about ways we can help you thrive.

The average rent for an apartment in Colorado Springs is about $1,553. For a more affordable apartment, consider a place in Old North End. If you’re willing to spend more, a one-bedroom apartment in Flying Horse Ranch averages $1,671. Keep that in mind while getting policies.

To lower your renters’ insurance premium, you have a few options. You can raise your deductible, bundle your policy, ask about available discounts, and choose the correct coverage amount. Alliance Insurance of the Rockies can find a high-value policy that works.

Whether your child needs renters’ insurance depends on various factors. If your homeowner policy covers them or if they’re living on campus, they may not need tenant insurance protection. Thankfully, they’re usually quite affordable for most types of renters.

Whether you can bundle your renters’ insurance with your other protection will vary depending on the provider. We can help you talk with your carrier and figure out whether or not you can add your renters’ policy to things like your car, health, or life insurance protection.

Being a responsible renter in Colorado Springs, Colorado, and El Paso County includes understanding renters’ insurance options. At Alliance Insurance of the Rockies, we’ll help you choose a tenant insurance policy that suits your needs. With over 25 years of experience, we’ll help protect you, your property, and your family from fire, water damage, theft, and other unforeseen circumstances.

Are you interested in learning more about cheap renters’ insurance in Colorado Springs? Please fill out the form to the right. We look forward to helping you find a high-value policy with protection you can trust for your home, apartment, or condo whenever you rent property. Our free quotes can help you get fantastic results.

Car accidents are a common occurrence on roads and highways across the United States, and they can have devastating consequences for those involved. Test your knowledge of car accident statistics with this quiz and discover the surprising facts and figures that may just save a life.